Internal Audit

An internal audit office directly subordinated to the board of directors is set up within our company to check the operation of every project and make recommendations to improve it. This is to ensure that the objectives such as "operational results and efficiency", "financial information reliability", and "relevant laws and regulations" are fully met. The internal auditing reports and subsequent follow-up reports are submitted to the supervisors, with execution progress fully reported by the audit manager to the board of directors during the course of meeting session.

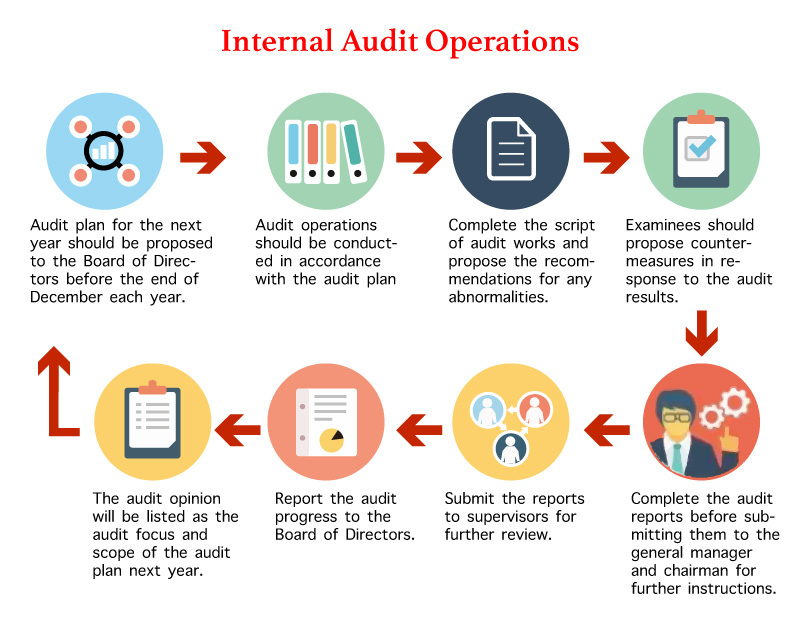

Internal audit flow chart is provided as below:

The internal audit is performed in accordance with the rules stipulated by the Financial Supervisory Committee. In addition to the major trading cycles (e.g.: engineering & collection, procurement & payment, investment, financing, production, salaries, fixed assets, etc.), specific details for internal auditing also include endorsement guarantee, capital loan, property management, budget management, financial statement, derivative financial products, related party transaction, Internal Audit Operations Audit plan for the next year should be proposed to the Board of Directors before the end of December each year. Audit operations should be conducted in accordance with the audit plan Complete the script of audit works and propose the recommendations for any abnormalities. Examinees should propose countermeasures in response to the audit results. Complete the audit reports before submitting them to the general manager and chairman for further instructions. Submit the reports to supervisors for further review. Report the audit progress to the Board of Directors. The audit opinion will be listed as the audit focus and scope of the audit plan next year. supervision & management of the subsidiary companies, operation of the board of directors, and prohibition of the insider trading, all of which should be reported to the supervisors in accordance with the existing regulations.

In order to prevent employee’s moral hazard from arising during the course of

business operation, in addition to strengthening strict requirements for personnel

ethics, business policies such as strict internal control, regulatory practice, and regular

occasional internal audit were also carried out to prevent the occurrence of

employee’s malpractices.